About Anchor Protocol

Market Stats

Market Cap

Not enough data

FDV

Not enough data

Circ. Supply

Not enough data

Max Supply

Not enough data

Total Supply

Not enough data

Performance

Popularity

Not enough data

Dominance

Not enough data

Volume (24H)

Not enough data

Volume (7D)

Not enough data

Volume (30D)

Not enough data

All time high

Not enough data

Price Change (1Y)

Not enough data

Additional details

Market details

ANC vs markets

Not enough data

ANC vs BTC

Not enough data

ANC vs ETH

Not enough data

Tags

Network & Addresses

Network | Address | |

|---|---|---|

Ethereum | 0x0F3ADC247E91c3c50bC08721355A41037E89Bc20 |

Price history

Time | Price | Change |

|---|---|---|

Today | $0.0035 | |

1 Day | $0.0035 | |

1 Week | $0.0035 | |

1 Month | $0.0035 | |

1 Year | $0.0051 |

FAQ

Anchor Protocol calculator

Related assets

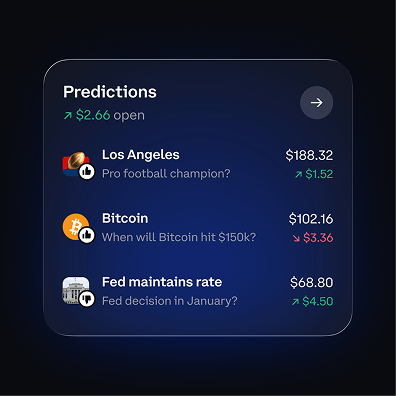

Popular prediction markets

Legal

Information is provided for informational purposes only and is not investment advice. This is not a recommendation to buy or sell a particular digital asset or to employ a particular investment strategy. Coinbase makes no representation on the accuracy, suitability, or validity of any information provided or for a particular asset.

Certain content has been prepared by third parties not affiliated with Coinbase Inc. or any of its affiliates and Coinbase is not responsible for such content. Coinbase is not liable for any errors or delays in content, or for any actions taken in reliance on any content. Information is provided for informational purposes only and is not investment advice. This is not a recommendation to buy or sell a particular digital asset or to employ a particular investment strategy. Coinbase makes no representation on the accuracy, suitability, or validity of any information provided or for a particular asset. Prices shown are for illustrative purposes only. Actual cryptocurrency prices and associated stats may vary. Data presented may reflect assets traded on Coinbase’s exchange and select other cryptocurrency exchanges.