About Apollo Diversified Credit Securitize Fund

This feeder fund invests in the Apollo Diversified Credit Fund ("Underlying Fund") which seeks to generate a return comprised of both current income and capital appreciation, emphasizing current income with low volatility and low correlation to the broader markets. ✓ Seasoned Asset Manager: Apollo draws on 30+ years of experience, aiming to achieve attractive returns across the risk spectrum through proprietary origination, credit strategies, and a flexible approach to borrower needs.(1) ✓ Historical Track Record of Outperformance: A diversified, global credit strategy with potential for enhanced income and attractive risk-adjusted returns across various market cycles. ✓ 0% Performance Fee ✓ $0 Redemptions ✓ Pricing Transparency: Daily pricing transparency and daily liquidity.(2) The Underlying Fund takes a multi-asset private and public credit approach centered around five key pillars: ✓ Corporate Direct Lending: Targets large scale corporate originations and sponsor-backed issuers of first lien, senior secured and unitranche loans, utilizing Apollo’s proprietary sourcing channel. ✓ Asset-Backed Lending: Focuses on agile deployment of capital into origination and proprietary sourcing channels across a broad mandate of asset-backed investments, with a focus on investments collateralized by tangible investments. ✓ Performing Credit: Primarily pursues liquid, performing senior secured corporate credits to generate total return. ✓ Dislocated Credit: Seeks to use contingent capital to tactically pursue “dislocated” credit opportunities such as stressed, performing assets that sell-off due to technical and/or non-fundamental reasons. ✓ Structured Credit: Focuses on structured credit opportunities across diverse asset types, vintages, maturities, jurisdictions, and capital structure priorities (for example, CLOs, residential, and commercial mortgage backed securities among others).9 (1) Diversification does not ensure profit or protect against loss. (2) Investment performance is not guaranteed and is subject to market risks.

Market Stats

Market Cap

$135.84M

0.02%

FDV

Not enough data

Circ. Supply

124K ACRED

Max Supply

Not enough data

Total Supply

124K ACRED

Diluted Valuation

$135.83M

Performance

Popularity

Not enough data

Dominance

0.01%

Volume (24H)

Not enough data

Volume (7D)

Not enough data

Volume (30D)

Not enough data

All time high

$1.10K

Price Change (1Y)

Not enough data

98.91%

Additional details

Market details

ACRED vs markets

↘ 98.57%

ACRED vs BTC

↘ 98.51%

ACRED vs ETH

↘ 98.61%

Tags

Network & Addresses

Network | Address | |

|---|---|---|

Ethereum | 0x17418038ecF73BA4026c4f428547BF099706F27B | |

Polygon | 0xFCe60bBc52a5705CeC5B445501FBAf3274Dc43D0 | |

Aptos | 0xe528f4df568eb9fff6398adc514bc9585fab397f478972bcbebf1e75dee40a88 | |

Avalanche C-Chain | 0x7C64925002BFA705834B118a923E9911BeE32875 |

Price history

Time | Price | Change |

|---|---|---|

Today | $1,095.46 | |

1 Day | $1,095.22 | |

1 Week | $1,094.53 | |

1 Month | $1,087.39 | |

1 Year | $0.00 |

FAQ

Social stats

Popularity in posts

#3762

Contributors

13

Posts

15

% About Apollo Diversified Credit Securitize Fund

0.001%

Articles

0

X (Twitter)

76.92% bullish

Sentiment

5.0 ★

Highlights

13 unique individuals are talking about Apollo Diversified Credit Securitize Fund and it is ranked #3,762 in most mentions and activity from collected posts. In the last 24 hours, across all social media platforms, Apollo Diversified Credit Securitize Fund has an average sentiment score of 5.0 out of 5. Finally, Apollo Diversified Credit Securitize Fund is becoming less newsworthy, with 0 news articles published about Apollo Diversified Credit Securitize Fund.

On Twitter, people are mostly bullish about Apollo Diversified Credit Securitize Fund. There were 76.92% of tweets with bullish sentiment compared to 0% of tweets with a bearish sentiment about Apollo Diversified Credit Securitize Fund. 23.08% of tweets were neutral about Apollo Diversified Credit Securitize Fund. These sentiments are based on 13 tweets.

On Reddit, Apollo Diversified Credit Securitize Fund was mentioned in 0 Reddit posts and there were 0 comments about Apollo Diversified Credit Securitize Fund. On average, there were less upvotes compared to downvotes on Reddit posts and more upvotes compared to downvotes on Reddit comments.

Powered by LunarCrush

Apollo Diversified Credit Securitize Fund calculator

Related assets

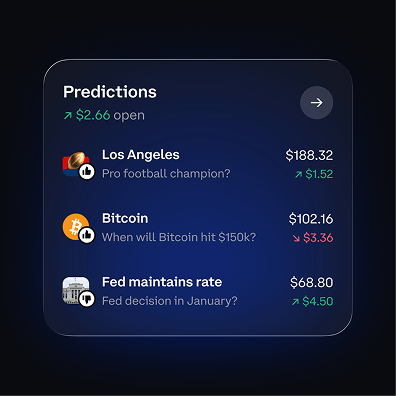

Popular prediction markets

Cryptocurrencies with similar market cap

Legal

Information is provided for informational purposes only and is not investment advice. This is not a recommendation to buy or sell a particular digital asset or to employ a particular investment strategy. Coinbase makes no representation on the accuracy, suitability, or validity of any information provided or for a particular asset.

Certain content has been prepared by third parties not affiliated with Coinbase Inc. or any of its affiliates and Coinbase is not responsible for such content. Coinbase is not liable for any errors or delays in content, or for any actions taken in reliance on any content. Information is provided for informational purposes only and is not investment advice. This is not a recommendation to buy or sell a particular digital asset or to employ a particular investment strategy. Coinbase makes no representation on the accuracy, suitability, or validity of any information provided or for a particular asset. Prices shown are for illustrative purposes only. Actual cryptocurrency prices and associated stats may vary. Data presented may reflect assets traded on Coinbase’s exchange and select other cryptocurrency exchanges.