About Multiverse Capital

You buy on BSC, we farm on multiple chains and return the profits to $MVC holders

Market Stats

Market Cap

Not enough data

3.13%

FDV

$485.47K

Circ. Supply

546B MVC

Max Supply

1T MVC

Total Supply

1T MVC

Diluted Valuation

$441.37K

Performance

Popularity

Not enough data

Dominance

0%

Volume (24H)

Not enough data

Volume (7D)

Not enough data

Volume (30D)

Not enough data

All time high

$0.000016

Price Change (1Y)

Not enough data

60.83%

Additional details

Market details

MVC vs markets

↗ 122.32%

MVC vs BTC

↗ 130.15%

MVC vs ETH

↗ 114.85%

Tags

farming-as-a-service

Network & Addresses

Network | Address | |

|---|---|---|

BNB Smart Chain | 0x80d04E44955AA9c3F24041B2A824A20A88E735a8 |

Price history

Time | Price | Change |

|---|---|---|

Today | $0.00000048 | |

1 Day | $0.00000050 | |

1 Week | $0.00000059 | |

1 Month | $0.00000081 | |

1 Year | $0.00000030 |

FAQ

Social stats

Popularity in posts

#4414

Contributors

4

Posts

4

% About Multiverse Capital

0.001%

Articles

0

X (Twitter)

0% bullish

Sentiment

1.7 ★

Highlights

4 unique individuals are talking about Multiverse Capital and it is ranked #4,414 in most mentions and activity from collected posts. In the last 24 hours, across all social media platforms, Multiverse Capital has an average sentiment score of 1.7 out of 5. Finally, Multiverse Capital is becoming less newsworthy, with 0 news articles published about Multiverse Capital.

On Twitter, people are mostly neutral about Multiverse Capital. There were 0% of tweets with bullish sentiment compared to 50% of tweets with a bearish sentiment about Multiverse Capital. 100% of tweets were neutral about Multiverse Capital. These sentiments are based on 3 tweets.

On Reddit, Multiverse Capital was mentioned in 1 Reddit posts and there were 5 comments about Multiverse Capital. On average, there were less upvotes compared to downvotes on Reddit posts and more upvotes compared to downvotes on Reddit comments.

Powered by LunarCrush

Multiverse Capital calculator

Related assets

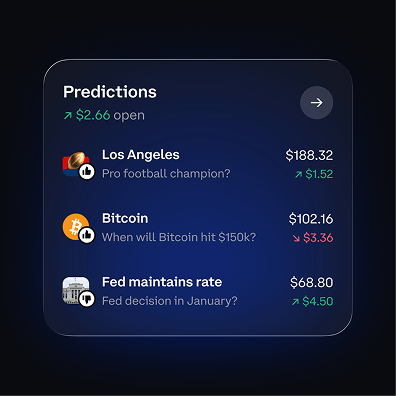

Popular prediction markets

Cryptocurrencies with similar market cap

Discover more assets

Legal

Information is provided for informational purposes only and is not investment advice. This is not a recommendation to buy or sell a particular digital asset or to employ a particular investment strategy. Coinbase makes no representation on the accuracy, suitability, or validity of any information provided or for a particular asset.

Certain content has been prepared by third parties not affiliated with Coinbase Inc. or any of its affiliates and Coinbase is not responsible for such content. Coinbase is not liable for any errors or delays in content, or for any actions taken in reliance on any content. Information is provided for informational purposes only and is not investment advice. This is not a recommendation to buy or sell a particular digital asset or to employ a particular investment strategy. Coinbase makes no representation on the accuracy, suitability, or validity of any information provided or for a particular asset. Prices shown are for illustrative purposes only. Actual cryptocurrency prices and associated stats may vary. Data presented may reflect assets traded on Coinbase’s exchange and select other cryptocurrency exchanges.